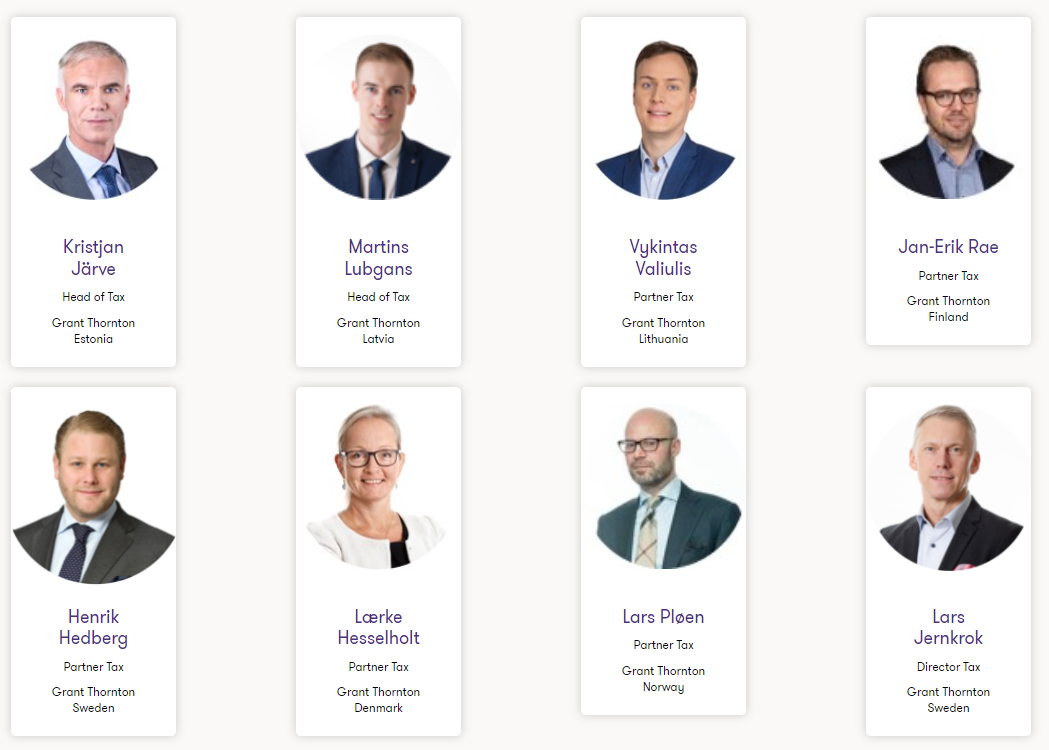

If you have similar challenges and questions, please contact our specialists.

What to keep in mind when declaring 2025 income?

From 16 February, the filing of 2025 income tax returns begins. As usual, a tax return must be filed if, during the year, you received income on which Estonian income tax was not withheld, or if you wish to claim tax reliefs.