If you have similar challenges and questions, please contact our specialists.

Defense fund financing increase

Defense fund financing sources (from 2026)

It is expected that the Defense Fund will additionally consist of:

- 2% of personal income tax directly allocated to the fund;

- State revenue from the newly introduced security contribution, calculated from non-life and property insurance premiums;

- 50% of the non-commercial real estate tax, for non-commercial property of residents other than their main residence, and the entire additional 0.2% real estate tax for commercial real estate.

In addition, it is intended to allocate a larger share of budget revenues to the Defense Fund, received from:

- Corporate income tax (CIT) - from 1.9% in 2025, to 8% in 2026 and 11.2% from 2027;

- Excise duties - from 4.1% in 2025, to 8% in 2026 and 8.4% from 2027.

These changes are based on the geopolitical situation and the need to ensure long-term stability in defense financing, especially in response to regional threats and strengthening NATO commitments.

The Ministry of Finance provides a presentation of the tax proposals package on its website (as of 30.05.2025).

New security contribution (from non-life insurance agreements)

A new mandatory security contribution is proposed for national security financing:

- 10% of non-life insurance premiums (e.g., property, travel insurance);

- 0% rate for mandatory civil liability insurance contracted with individuals (except for carrying out economic activities).

The contribution will supplement the income of the State Defense Fund and will be administered through insurance companies (14 insurers established in Lithuania, and insurers operating without establishment).

Proposed corporate income tax changes

Rate increase by 1 percentage point

A standard corporate tax rate increase from 16% to 17% would take effect in 2026. This would also increase the rate for small businesses from 6% to 7%.

Small business tax relief (0%) extended from 1 to 2 years

The period during which newly registered small businesses will be subject to a 0% corporate tax rate on profits earned is being extended. This period will be extended from 1 to 2 years in order to provide additional support to growing businesses.

New depreciation allowance for fixed assets

It is envisaged to allow a possibility of applying instantaneous depreciation of fixed assets to the asset groups "Machinery and equipment", "Equipment (structures, wells, etc.)", "Computer equipment and communications equipment", "Software", "Acquired rights", and "Trucks, trailers and semi-trailers".

This preferential instantaneous depreciation does not apply to assets that are subject to the investment projects relief under Article 46-1 of the Corporate Income Tax Law (i.e., it is possible to chose, to either depreciate immediately but only once through instantaneous depreciation, or twice – by applying the investment projects relief and then also further depreciating the asset in the "classic" way).

Restriction on group loss carryforwards

It is planned to limit the possibility of tax loss carryforwards to 70% of the company's taxable income. It is also determined that the conditions of duration (2 years) and scope (2/3) of group membership are assessed on the last day of the period, and not at the moment of transfer, as previously established by the Supreme Administrative Court of Lithuania. The motivation is indicated as the desire to prevent abuses.

STEM Scholarship Deduction

A possibility is envisaged for companies to deduct scholarships for students and researchers in the STEM fields (science, technology, engineering and mathematics) as expenses, up to EUR 2,500 per tax period under tripartite agreements, in order to promote science and technology.

Proposed changes to the personal income tax

Personal Income Tax (PIT)

It is planned to change the PIT rates, applying them taking into account the total annual amount of all types of income, except income from distributed profits:

- The portion of income not exceeding 36 average salaries (~EUR 82,962) would be taxed at a rate of 20%;

- The portion of income exceeding 36 average salaries (~EUR 82,962) but not exceeding 60 average salaries (EUR 138,270) would be taxed at a rate of 25%;

- The portion of income exceeding 60 average salaries (EUR 138,270) would be taxed at a rate of 32%;

36% tax rate was rejected and is no longer proposed by the Government.

The 15% rate applies to dividends, sales of retained shares, life insurance and pension savings benefits (for which tax exemption was used), social benefits (sickness, maternity, paternity, childcare, etc.).

The Ministry of Finance provides examples of PIT calculations on its website (as of 29.05.2025).

An annual contribution limit of EUR 350 is envisaged for health insurance premiums (the amount in excess would be taxed as personal income).

It is also envisaged that the non-taxable limit will not be applied to residents receiving more than 1 average salary per month.

Proposed changes to real estate tax

- An additional 0.2% tariff component has been established for commercial real estate (to the state budget / defence fund);

- For the main residence, a tax-free amount of at least 10 thousand EUR is envisaged. The exact amount will be determined by the relevant municipal council.

- 50% relief for housing declared as a place of residence (for the part of the real estate value up to 450 thousand EUR).

- 75% relief for housing declared as a place of residence for families with 3 children or raising a disabled child (for the part of the real estate value up to 450 thousand EUR);

- Rates for primary residence – from 0.1 to 1% of the value of the residence, above the non-taxable amount.

- For residents, the tax administrator will prepare real estate tax returns.

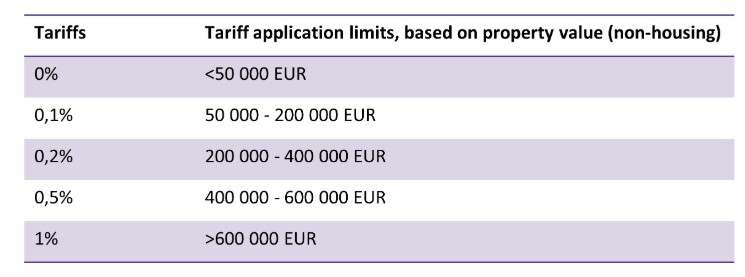

For other non-commercial real estate, progressive rates apply – see table below.

Proposed VAT and excise duties changes

VAT Changes

The reduced VAT rate will be increased to 12% (from 9%) for:

- Accommodation services;

- Passenger transport services;

- Attendance at art and cultural events and institutions.

The reduced VAT rate will be decreased to 5% (from 9%) for:

- Books and non-periodical informational publications.

The 9% rate for heating, firewood, and hot water will be abolished – the standard 21% rate will be applied.

Excise duties changes

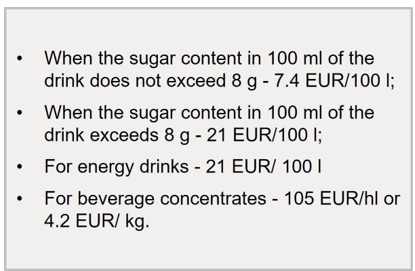

In order to contribute to the financing of state defense and public health policy goals, it is proposed to tax non-alcoholic sweetened beverages, energy drinks, and beverage concentrates, thus avoiding a potential substitution effect.